BILLING FOR SERVICES OF EMPLOYEES PAID ON A MONTHLY BASIS - 8299

This section provides the methodology and formula for determining the hourly billing rate when a department bills for the services of employees paid on a monthly basis on or after January 1, 2026.

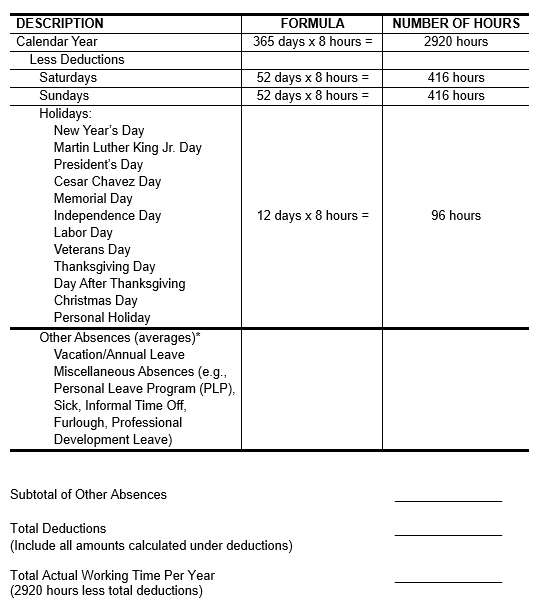

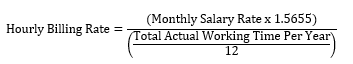

The hourly billing rate is computed using the total actual working time per year and the state’s staff benefit contribution percentage. The total actual working time per year is determined by deducting the number of hours for Saturdays, Sundays, holidays, and other absences from the total hours for the calendar year. To determine other absences, departments will compile and calculate a separate average for each type of absence, such as vacation/annual leave and miscellaneous absences (e.g., Personal Leave Program (PLP), sick, informal time off, furlough, professional development leave).

The hourly billing rate formula provides billing based on actual hours worked. It does not include costs such as identifiable operating expenses incurred in rendering the service, charges for non-incidental use of equipment, overhead, and other costs. In addition, Workers’ Compensation, Industrial Disability, Unemployment Compensation, and Life Insurance benefits are excluded from the formula as these expenses can vary substantially among departments. Such costs should be included in billing for services in accordance with SAM Sections 9211 and 9217.1.

*Statewide data is not available. Each department must compile the information for other absences, based on previous experience and expertise.

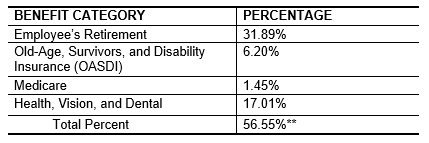

STATE’S STAFF BENEFIT CONTRIBUTION PERCENTAGES

(Effective January 1, 2026)

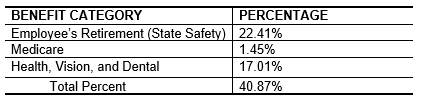

**The staff benefit contribution rate is applicable only to employees who are Miscellaneous Tier 1 members of the Public Employees’ Retirement System. If an employee is not a Miscellaneous Tier 1 member, but is still contributing to OASDI (i.e., Social Security), their appropriate retirement contribution rate will be substituted for the 31.89 percent rate. Those employees who are not Miscellaneous Tier 1 members and do not contribute to OASDI will include their appropriate retirement, Medicare, and health, vision, and dental benefit rates. For example, the appropriate total rate to be used for members of the Safety Retirement Category who do not contribute to OASDI is as follows:

Departments with employee members in different retirement categories may use a composite employer contribution rate based on their experience. If more accurate rates can be determined through actual operations, departments may use other rates for OASDI, Medicare, and health, vision, and dental benefits.

FORMULA FOR CALCULATING THE HOURLY BILLING RATE:

The monthly salary rate should be adjusted as necessary to reflect (average) salary reductions for PLPs.

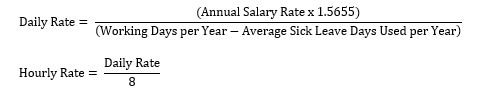

FORMULA FOR CALCULATING THE DAILY RATE FOR 2,000 HOURS OR LESS PER YEAR:

The number of working hours per month is not appropriate for employees not expected to work 2,000 hours per year, less vacation/annual leave and sick leave. In such instances, an estimate of actual working time per month or year, considering average holiday, vacation/annual leave, and sick leave should be used. For example, billing rates for academic year employees, such as college instructors, would be computed based on the number of workdays in a year, less the average of sick leave usage. Holidays and vacations are not considered in this instance since they are considered in determining the number of working days.

Revisions

- BILLING FOR SERVICES OF EMPLOYEES PAID ON MONTHLY BASIS - 04/2025

- BILLING FOR SERVICES OF EMPLOYEES PAID ON MONTHLY BASIS - 02/2024

- BILLING FOR SERVICES OF EMPLOYEES PAID ON MONTHLY BASIS - 06/2023

- BILLING FOR SERVICES OF EMPLOYEES PAID ON MONTHLY BASIS - 02/2022

- BILLING FOR SERVICES OF EMPLOYEES PAID ON MONTHLY BASIS - 01/2021

- BILLING FOR SERVICES OF EMPLOYEES PAID ON MONTHLY BASIS - 10/2020